Insights

Stay Informed with Our

Recent Updates

The Social Security Fairness Act

On January 5th, 2025 President Biden signed the Social Security Fairness Act into law. This Act ends the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These provisions impacted approximately 3.2 million Americans who received a pension not covered by Social Security. The WEP adjusted Social Security benefits lower for individuals that worked in…

Understanding the Term “Fee-Only” in Financial Advising

The term “fee-only” is becoming increasingly prominent in financial advising, but its precise meaning and implications can be confusing. Here’s a closer look at what “fee-only” means, the standards set by the CFP Board, and how this designation impacts the way financial advisors are compensated and how they disclose potential conflicts of interest. What Does…

Navigating Financial Planning: The Importance of a Fiduciary Financial Advisor

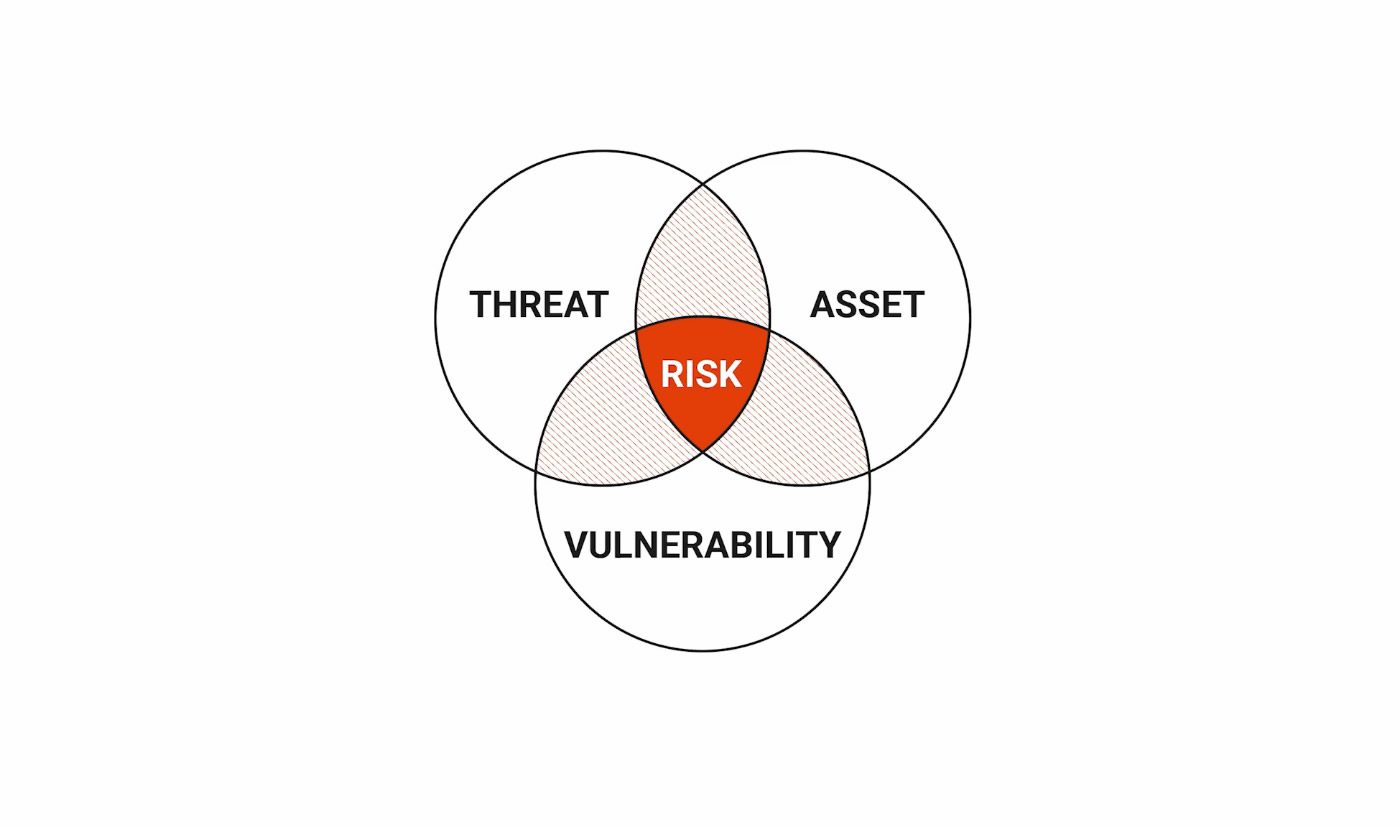

Financial planning can be complex. From crafting an investment strategy and developing an estate plan to managing risks and handling everyday personal finance matters, the expertise of a good financial advisor can be invaluable. But how do you ensure your financial advisor is truly looking out for your best interests? The key is to determine…

Tax Cuts and Jobs Act

In December of 2017, President Trump signed into law the Tax Cuts and Jobs Act (TCJA). TCJA brought many changes to the tax code for corporate and individual income taxes. Among those changes were reductions to the Federal marginal income tax brackets ranging from 1-4% depending on the marginal bracket. By law, these reductions are…

Tax Planning for ROTH Conversions

Are you taking advantage of ROTH conversions? If so great! Here at Culbreth Wealth Management, we are big fans of ROTH retirement vehicles (ROTH 401K, ROTH SEP IRA, ROTH IRA & etc.) because of the favorable tax status. ROTH retirement vehicles allow the investor to invest after-tax dollars, have tax-free growth and distribute tax-free. At…

Retirement Plan Ideal for Pass Through Entities with No Employees

At Culbreth Wealth Management we have great appreciation for fellow small business owners for all that they accomplish despite the many challenges they face. Many seasoned businesses today have been through not one but in some cases two crises and made it out on the other side. It is remarkable what some of them have…

Low Taxes in Retirement

In all my experience in wealth management, if there is one thing that does not change, it is that clients do not like to pay taxes, and especially in retirement. I’ll bet you don’t like taxes either. Who does? Did you know that it is possible to have high income and a low tax liability…

A Housing Bust Comes for Thousands of Small-Time Investors

They were offered the benefits of owning apartment-building rentals without any of the work, in real-estate investments that have already left some people empty-handed. From 2020 through 2022, real estate syndicators reported raising at least $115 billion from investors, according to a Wall Street Journal analysis of Securities and Exchange Commission filings.

Debt-Ceiling Fight Sends Investors Hunting for New Havens

Traders worried about a potential U.S. default are swapping their go-to safe haven for the bonds of America’s top-rated companies.

Jamie Dimon warns souring commercial real estate loans could threaten some banks

Deposit runs have led to the collapse of three U.S. banks this year, but another concern is building on the horizon. Commercial real estate is the area most likely to cause problems for lenders, JPMorgan Chase CEO Jamie Dimon told analysts Monday. “There’s always an off-sides,” Dimon said in a question-and-answer session during his bank’s investor conference. “The off-sides in…

PacWest shares extend gains on $2.6 bln real estate loan sale

May 23 – PacWest Bancorp’s (PACW.O) shares rose nearly 13%, extending gains from the previous session driven mostly by news that the lender would sell $2.6 billion worth of its loan portfolio to bolster its finances. The stock was trading up at $7.06 on Tuesday, helping to lift the shares of other regional lenders with the KBW…

At 20.92%, the average credit card interest rate is higher than it has been at any point since the Federal Reserve started tracking this information in 1994

Understanding the credit card climate is important for two reasons. First, credit card offers change regularly, based on the health of the economy and issuers’ business objectives. So being able to see the bigger picture – averages, trends, etc. – gives you a baseline against which to compare offers. And that will help you find…

US Bank Lending Slumps by Most on Record in Final Weeks of March

US bank lending contracted by the most on record in the last two weeks of March, indicating a tightening of credit conditions in the wake of several high-profile bank collapses that risks damaging the economy. Commercial bank lending dropped nearly $105 billion in the two weeks ended March 29, the most in Federal Reserve data…

A $1.5 Trillion Wall of Debt Is Looming for US Commercial Properties

Almost $1.5 trillion of US commercial real estate debt comes due for repayment before the end of 2025. The big question facing those borrowers is who’s going to lend to them? “Refinancing risks are front and center” for owners of properties from office buildings to stores and warehouses, Morgan Stanley analysts including James Egan wrote…