On January 5th, 2025 President Biden signed the Social Security Fairness Act into law. This Act ends the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These provisions impacted approximately 3.2 million Americans who received a pension not covered by Social Security. The WEP adjusted Social Security benefits lower for individuals that worked in both Social Security covered and non-covered employment that would otherwise receive full Social Security benefits. The GPO reduced Social Security spousal or survivor benefits by up to two-thirds of the recipient’s pension, significantly reducing the benefits of surviving spouses.

WEP and GPO impacted teachers, firefighters, police officers, federal employees covered by the Civil Service Retirement System, and people whose work was covered by a foreign social security system.

Individuals affected by WEP and GPO could potentially receive higher Social Security Benefits resulting in an increase of $1,000 or more per month! Others may only see a modest increase. According to the SSFA December 2023 is the last month that the WEP and GPO will apply, and benefits will be adjusted in arrears dating back to January 2024 as well as future benefits. The SSA is in the process of creating a plan to implement the SSFA and is uncertain on the timing of implementation as some adjustments will require manual adjusting.

If you think you might fall into one of the affected categories, it would be wise to investigate your benefits to see if you qualify for an increase. If you did not apply for benefits because of disqualifications due to GPO, SSA is guiding you to reapply for your benefits!

If you have questions regarding the Social Security Fairness Act or its financial planning implications, please contact Culbreth Wealth Management for more information.

Culbreth Wealth Management

Office: (770) 979-1301

e-mail: info@culbrethwm.com

The term “fee-only” is becoming increasingly prominent in financial advising, but its precise meaning and implications can be confusing. Here’s a closer look at what “fee-only” means, the standards set by the CFP Board, and how this designation impacts the way financial advisors are compensated and how they disclose potential conflicts of interest.

A “fee-only” financial advisor is compensated solely by the client. This means they do not receive commissions, referral fees, or other forms of compensation from third parties, such as mutual funds or insurance companies. The primary advantage of working with a fee-only advisor is that their compensation structure helps to minimize conflicts of interest, aligning their recommendations more closely with the client’s best interests.

The Certified Financial Planner (CFP) Board has stringent requirements for advisors who wish to use the “fee-only” designation. According to the CFP Board, a financial planner can describe their practice as “fee-only” if:

Choosing a fee-only advisor can provide peace of mind that the financial advice you receive is not influenced by outside compensation. Since fee-only advisors do not earn commissions from product sales, they can offer more objective advice that is tailored to the client’s specific needs and financial goals.

It’s important to differentiate between “fee-only” and other common compensation models in financial advising:

Transparency in compensation and potential conflicts of interest is critical in financial advising. The CFP Board requires fee-only advisors to provide clear and comprehensive disclosure of all forms of compensation. This disclosure helps clients understand how their advisor is paid and identify any potential conflicts of interest.

Choosing a fee-only financial advisor can be a prudent decision for individuals seeking unbiased financial advice. The fee-only model reduces conflicts of interest and aligns the advisor’s incentives with the client’s goals. By understanding the meaning of “fee-only” and the standards set by the CFP Board, clients can make more informed decisions when selecting a financial advisor.

Financial planning can be complex. From crafting an investment strategy and developing an estate plan to managing risks and handling everyday personal finance matters, the expertise of a good financial advisor can be invaluable. But how do you ensure your financial advisor is truly looking out for your best interests? The key is to determine if your advisor is a “fiduciary.” So, what does it mean to be a fiduciary?

A fiduciary financial advisor is obligated to recommend the best investment solutions for their clients. Unlike non-fiduciary advisors who only need to suggest “suitable” options, fiduciary advisors must adhere to a higher standard, ensuring their recommendations are in the clients’ best interests.

Before hiring a financial advisor, it’s crucial to explicitly ask if they will always act as a fiduciary. Knowing what to look for and the right questions to ask can help you identify fiduciary advisors more easily today.

One reliable way to ensure your advisor acts as a fiduciary is to hire a Certified Financial Planner (CFP). CFPs commit to the CFP Board’s Code of Ethics and Standards of Conduct, promising to act as fiduciaries when providing financial advice.

This commitment means a CFP professional prioritizes each client’s well-being above their own or their firm’s interests. Fiduciary duty also requires them to disclose any material conflicts of interest. They must act with care, skill, prudence, and diligence to best serve their clients’ goals and comply with all relevant laws and regulations.

Despite its importance, the term “fiduciary” is not widely understood. Many investors are misled by vague titles like “financial advisor” or “senior planner.” Beware of quick certification programs that can be completed in just a few days, which some advisors use to claim expertise.

Finding a fiduciary advisor is challenging because the responsibility falls on the individual. Most people lack financial expertise and the time to thoroughly research advisory firms to identify the right fiduciary for their needs.

Why is it so vital for your financial advisor to be a fiduciary? Without this obligation, advisors might recommend products that are not optimal for your situation but generate higher commissions and fees for them. Non-fiduciary advisors might also suggest complex and opaque products to prevent clients from questioning their strategies.

Fiduciary financial advisors mitigate conflicts of interest by often choosing not to offer certain products directly. Instead, they might recommend clients purchase these products elsewhere. When they do offer specific products or services, fiduciary advisors disclose any conflicts of interest, prioritize their clients’ interests, and act without regard to their own financial gain.

Hiring a fiduciary advisor is not necessarily more expensive than hiring a non-fiduciary. Fiduciaries often work on a fee-only basis, which might involve an annual planning charge of a few thousand dollars. Many advisors use a fee structure based on “assets under management,” where clients pay a percentage of their portfolio value each year, typically no more than 1%.

A fiduciary advisor is required to act solely in their clients’ best interests, placing the client’s financial needs above their own. In a landscape filled with complex and opaque investment products, working with a fiduciary is more crucial than ever.

In December of 2017, President Trump signed into law the Tax Cuts and Jobs Act (TCJA). TCJA brought many changes to the tax code for corporate and individual income taxes. Among those changes were reductions to the Federal marginal income tax brackets ranging from 1-4% depending on the marginal bracket. By law, these reductions are set to sunset (expire) at the end of 2025, unless Congress men and women vote to extend the TCJA or pass new tax legislation.

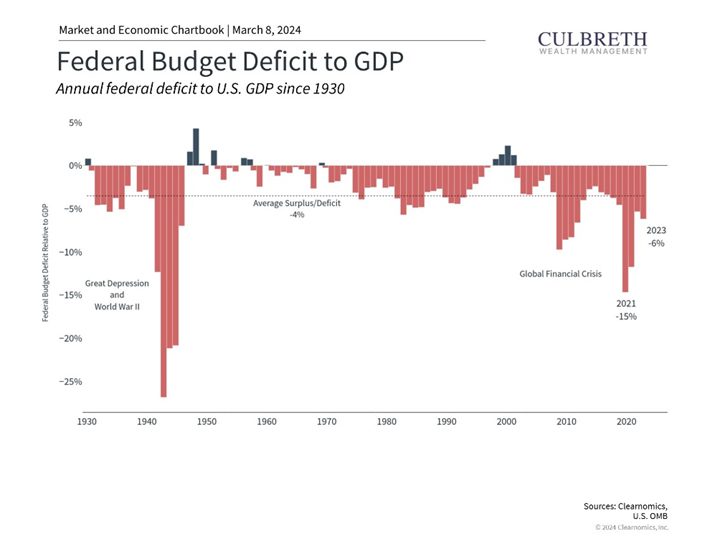

Extending the TCJA or passing new tax legislation that does not meaningfully increase taxes may be challenging for Congress regardless of pollical party affiliation. Since the onset of the COVID pandemic in 2020, Congress has passed over $5 trillion across multiple stimulus packages. In combination, the TCJA and the massive COVID stimulus has resulted in significant Federal budget deficits for the last 5 years, dwarfing the historical average. From a planning perspective, at Culbreth Wealth Management we are assuming the TCJA expires and reverts to the previous marginal brackets before TCJA.

For investors with pre-tax retirement savings, this presents an opportunity to maximize the marginal tax brackets for tax years 2024 and 2025, while the TCJA is still in effect. To do this, an individual or married couple can implement ROTH conversions to the top of their highest marginal bracket to lock in the favorable tax rates. A ROTH conversion is where you convert pre-tax IRA or 401K dollars into after-tax tax-free ROTH dollars.

If the tax planning is completed early in the year, to determine the amount of room remaining in the desired tax bracket, you can then be strategic in the timing of the ROTH conversion. To further maximize the impact, you can execute the conversion during a market correction, but you will need to know the amount to convert in advance.

To discuss this or any other financial planning related topic please reach out to schedule an initial consultation at no cost at info@culbrethwm.com.

Culbreth Wealth Management is a state registered investment advisor. Information and statements made here are not intended to create, and receipt does not constitute, a client relationship. There are risks inherent in investing, including the potential loss of principal.

Are you taking advantage of ROTH conversions? If so great! Here at Culbreth Wealth Management, we are big fans of ROTH retirement vehicles (ROTH 401K, ROTH SEP IRA, ROTH IRA & etc.) because of the favorable tax status. ROTH retirement vehicles allow the investor to invest after-tax dollars, have tax-free growth and distribute tax-free. At death, the beneficiary can even defer distributions for an additional 10 years! Also, unlike traditional IRAs, ROTH IRAs do not have mandatory distributions.

So how do you get more of your savings into ROTH retirement vehicles? An easy way is to elect ROTH contributions for your employer’s retirement plan. Another way is to implement a ROTH conversion strategy. This is where you convert pre-tax dollars in your IRA (or 401K) into after-tax dollars in a ROTH IRA (or ROTH 401k) over a period of years to efficiently maximize your tax brackets. It is recommended to pay the tax owed on the conversion with cash outside of your retirement account, especially if you are younger than age 59.5 to avoid a 10% penalty. Additionally, you need to be aware of the ROTH IRA 5 -year rule on distributions.

To maximize the potential impact of ROTH conversions you can do tax planning each year to estimate the amount of room in the tax bracket that you want to stay under. By doing this you will know the amount of the ROTH conversion earlier in the year (as opposed to waiting until December) so you can be proactive in the timing of the conversion.

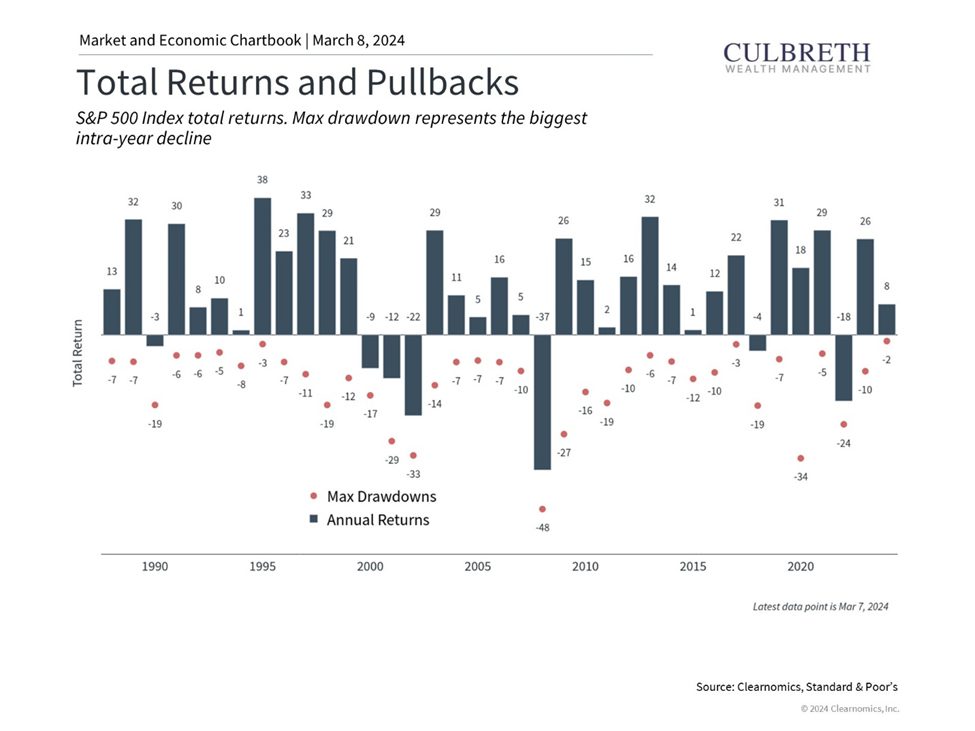

Most years, the market provides an opportunity via a correction to implement a ROTH conversion at lower market values. 19 of the last 20 years, the S&P 500 has finished the year greater than 10% higher than the lowest point of max drawdown. 16 of those years, it finished greater than 15% higher than the lowest drawdown. This means that each year, there is a great opportunity with margin for error, to execute a ROTH conversion at a lower point in the market when a correction occurs. So next time the market drops, do not get anxious over the volatility, instead get excited about executing a ROTH conversion! If you do not do the tax planning in advance however, you are not likely to know how much to do without going into the next tax bracket.

To discuss this or any other financial planning related topic please reach out to schedule an initial consultation at no cost at info@culbrethwm.com.

Culbreth Wealth Management is a state registered investment advisor. Information and statements made here are not intended to create, and receipt does not constitute, a client relationship. There are risks inherent in investing, including the potential loss of principal.

At Culbreth Wealth Management we have great appreciation for fellow small business owners for all that they accomplish despite the many challenges they face. Many seasoned businesses today have been through not one but in some cases two crises and made it out on the other side. It is remarkable what some of them have endured the last four years and even so, after all the challenges they hurdle, the one that remains is how to manage their tax liability? At the end of the day everybody pays taxes. For pass through entities, that flows to the business owner.

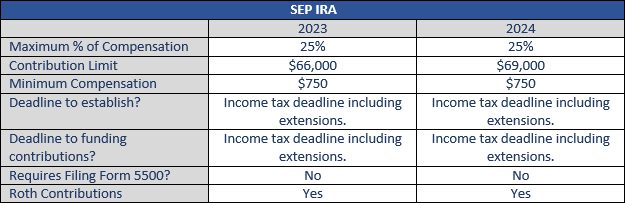

As the owner of a pass-through small business, are you uneasy about the amount you will owe for 2023? The good news for small businesses owners is that the government provides a very easy way to reduce your taxes via qualified retirement plans. For tax year 2023, business owners with no employees can utilize the SEP IRA or Solo 401K to defer up to $66,000 or 25% of compensation, whichever is lower. Additionally, it is not too late to set up one of these retirement plans! The owner has until the tax filing deadline (plus extensions for SEP IRAs) to make these contributions and claim them as deductions for tax year 2023.

We encourage small business owners that are thinking about utilizing a retirement plan as a tax reduction strategy to incorporate it into a larger overall financial plan. Do this and be amazed at what you can accomplish! Plan, implement and execute to not only have a lower tax liability but for a grander goal that those proceeds can endow. It is not too late for tax year 2023.

To discuss this or any other financial planning related topic please reach out to schedule an initial consultation at no cost at info@culbrethwm.com.

Culbreth Wealth Management is a fee-only registered investment advisor. CWM and its investment advisor representatives are fiduciaries, do not sell products or accept commissions, and act in the best interest of its clients.

Culbreth Wealth Management is a state registered investment advisor. Information and statements made here are not intended to create, and receipt does not constitute, a client relationship. There are risks inherent in investing, including the potential loss of principal.

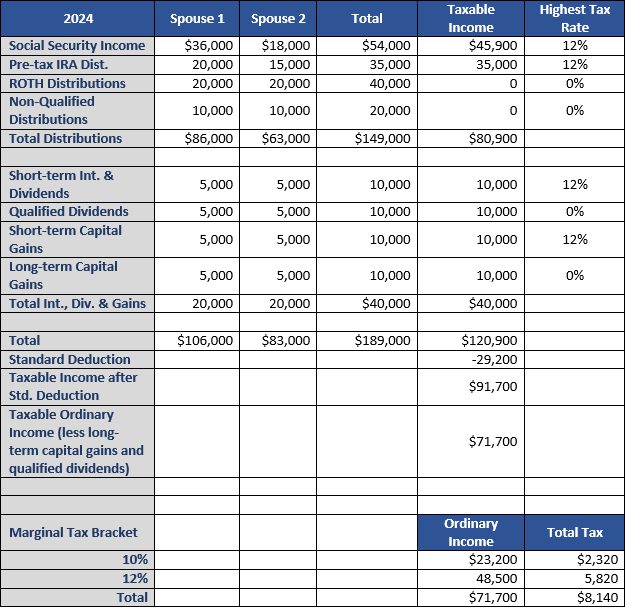

In all my experience in wealth management, if there is one thing that does not change, it is that clients do not like to pay taxes, and especially in retirement. I’ll bet you don’t like taxes either. Who does? Did you know that it is possible to have high income and a low tax liability in retirement? In fact, it is not that difficult to do if you plan for it in advance. I’ll show you how you can have $149,000 a year in distributions in retirement and only pay less than $8,140 a year in Federal income tax!

The key to limiting Federal income tax in retirement is to control your marginal tax bracket and take distributions from tax-free sources. If you do, you may be able to keep your taxable income below a key threshold of $94,050. For tax year 2024, for a couple filing Married Filing Jointly (MFJ) and their taxable income is below $94,050, their long-term capital gains and qualified dividend rate is 0%. That’s right! Z-e-r-o!

To achieve this in retirement, you have to plan for it in advance. That means in the accumulation phase before retirement, contributing towards ROTH retirement accounts and completing ROTH conversions in an efficient, strategic manner. Don’t get to retirement with most of your savings in pre-tax retirement accounts. If you do, the end result is having to pay taxes to distribute which will drive your taxable income even higher, especially once you reach the Required Minimum Distribution age.

If planned properly, in the distribution phase you will be able to distribute from ROTH sources, after-tax sources and pay 0% taxes on long-term capital gains and qualified dividends. To accomplish this, you need to create a financial plan and actively manage towards this goal. It is not likely to be achieved by happenstance. Obviously, everyone’s situation will differ with unique challenges, but each person can strive towards lower taxes in retirement with good planning. If this type of goal interests you, please reach out and let’s talk about it!

To discuss this or any other financial planning related topic please reach out to schedule an initial consultation at no cost at info@culbrethwm.com.

*This example is a thought exercise and not intended to be a precise calculation of tax owed.

Culbreth Wealth Management is a state registered investment advisor. Information and statements made here are not intended to create, and receipt does not constitute, a client relationship. There are risks inherent in investing, including the potential loss of principal.

They were offered the benefits of owning apartment-building rentals without any of the work, in real-estate investments that have already left some people empty-handed.

From 2020 through 2022, real estate syndicators reported raising at least $115 billion from investors, according to a Wall Street Journal analysis of Securities and Exchange Commission filings.

Traders worried about a potential U.S. default are swapping their go-to safe haven for the bonds of America’s top-rated companies.