Retirement Plan Ideal for Pass Through Entities with No Employees

Posted on January 29, 2025At Culbreth Wealth Management we have great appreciation for fellow small business owners for all that they accomplish despite the many challenges they face. Many seasoned businesses today have been through not one but in some cases two crises and made it out on the other side. It is remarkable what some of them have endured the last four years and even so, after all the challenges they hurdle, the one that remains is how to manage their tax liability? At the end of the day everybody pays taxes. For pass through entities, that flows to the business owner.

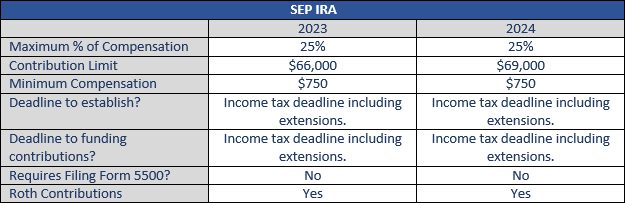

As the owner of a pass-through small business, are you uneasy about the amount you will owe for 2023? The good news for small businesses owners is that the government provides a very easy way to reduce your taxes via qualified retirement plans. For tax year 2023, business owners with no employees can utilize the SEP IRA or Solo 401K to defer up to $66,000 or 25% of compensation, whichever is lower. Additionally, it is not too late to set up one of these retirement plans! The owner has until the tax filing deadline (plus extensions for SEP IRAs) to make these contributions and claim them as deductions for tax year 2023.

We encourage small business owners that are thinking about utilizing a retirement plan as a tax reduction strategy to incorporate it into a larger overall financial plan. Do this and be amazed at what you can accomplish! Plan, implement and execute to not only have a lower tax liability but for a grander goal that those proceeds can endow. It is not too late for tax year 2023.

To discuss this or any other financial planning related topic please reach out to schedule an initial consultation at no cost at info@culbrethwm.com.

Culbreth Wealth Management is a fee-only registered investment advisor. CWM and its investment advisor representatives are fiduciaries, do not sell products or accept commissions, and act in the best interest of its clients.

Culbreth Wealth Management is a state registered investment advisor. Information and statements made here are not intended to create, and receipt does not constitute, a client relationship. There are risks inherent in investing, including the potential loss of principal.