Tax Cuts and Jobs Act

Posted on January 29, 2025In December of 2017, President Trump signed into law the Tax Cuts and Jobs Act (TCJA). TCJA brought many changes to the tax code for corporate and individual income taxes. Among those changes were reductions to the Federal marginal income tax brackets ranging from 1-4% depending on the marginal bracket. By law, these reductions are set to sunset (expire) at the end of 2025, unless Congress men and women vote to extend the TCJA or pass new tax legislation.

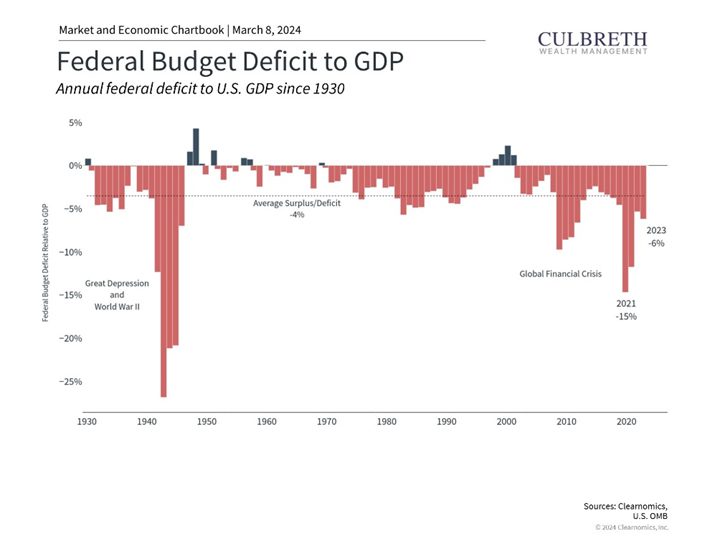

Extending the TCJA or passing new tax legislation that does not meaningfully increase taxes may be challenging for Congress regardless of pollical party affiliation. Since the onset of the COVID pandemic in 2020, Congress has passed over $5 trillion across multiple stimulus packages. In combination, the TCJA and the massive COVID stimulus has resulted in significant Federal budget deficits for the last 5 years, dwarfing the historical average. From a planning perspective, at Culbreth Wealth Management we are assuming the TCJA expires and reverts to the previous marginal brackets before TCJA.

For investors with pre-tax retirement savings, this presents an opportunity to maximize the marginal tax brackets for tax years 2024 and 2025, while the TCJA is still in effect. To do this, an individual or married couple can implement ROTH conversions to the top of their highest marginal bracket to lock in the favorable tax rates. A ROTH conversion is where you convert pre-tax IRA or 401K dollars into after-tax tax-free ROTH dollars.

If the tax planning is completed early in the year, to determine the amount of room remaining in the desired tax bracket, you can then be strategic in the timing of the ROTH conversion. To further maximize the impact, you can execute the conversion during a market correction, but you will need to know the amount to convert in advance.

To discuss this or any other financial planning related topic please reach out to schedule an initial consultation at no cost at info@culbrethwm.com.

Culbreth Wealth Management is a state registered investment advisor. Information and statements made here are not intended to create, and receipt does not constitute, a client relationship. There are risks inherent in investing, including the potential loss of principal.