Tax Planning for ROTH Conversions

Posted on January 29, 2025Are you taking advantage of ROTH conversions? If so great! Here at Culbreth Wealth Management, we are big fans of ROTH retirement vehicles (ROTH 401K, ROTH SEP IRA, ROTH IRA & etc.) because of the favorable tax status. ROTH retirement vehicles allow the investor to invest after-tax dollars, have tax-free growth and distribute tax-free. At death, the beneficiary can even defer distributions for an additional 10 years! Also, unlike traditional IRAs, ROTH IRAs do not have mandatory distributions.

So how do you get more of your savings into ROTH retirement vehicles? An easy way is to elect ROTH contributions for your employer’s retirement plan. Another way is to implement a ROTH conversion strategy. This is where you convert pre-tax dollars in your IRA (or 401K) into after-tax dollars in a ROTH IRA (or ROTH 401k) over a period of years to efficiently maximize your tax brackets. It is recommended to pay the tax owed on the conversion with cash outside of your retirement account, especially if you are younger than age 59.5 to avoid a 10% penalty. Additionally, you need to be aware of the ROTH IRA 5 -year rule on distributions.

To maximize the potential impact of ROTH conversions you can do tax planning each year to estimate the amount of room in the tax bracket that you want to stay under. By doing this you will know the amount of the ROTH conversion earlier in the year (as opposed to waiting until December) so you can be proactive in the timing of the conversion.

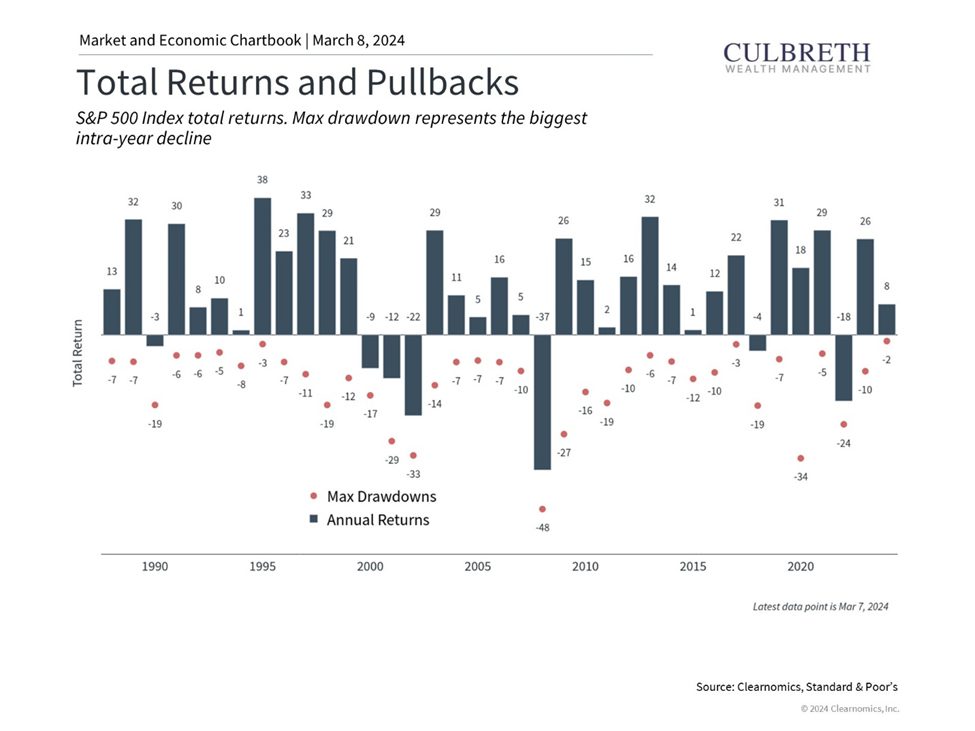

Most years, the market provides an opportunity via a correction to implement a ROTH conversion at lower market values. 19 of the last 20 years, the S&P 500 has finished the year greater than 10% higher than the lowest point of max drawdown. 16 of those years, it finished greater than 15% higher than the lowest drawdown. This means that each year, there is a great opportunity with margin for error, to execute a ROTH conversion at a lower point in the market when a correction occurs. So next time the market drops, do not get anxious over the volatility, instead get excited about executing a ROTH conversion! If you do not do the tax planning in advance however, you are not likely to know how much to do without going into the next tax bracket.

To discuss this or any other financial planning related topic please reach out to schedule an initial consultation at no cost at info@culbrethwm.com.

Culbreth Wealth Management is a state registered investment advisor. Information and statements made here are not intended to create, and receipt does not constitute, a client relationship. There are risks inherent in investing, including the potential loss of principal.