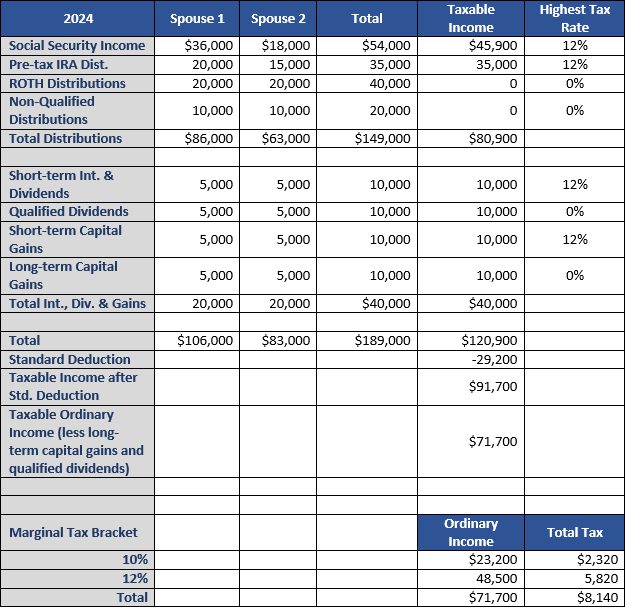

In all my experience in wealth management, if there is one thing that does not change, it is that clients do not like to pay taxes, and especially in retirement. I’ll bet you don’t like taxes either. Who does? Did you know that it is possible to have high income and a low tax liability in retirement? In fact, it is not that difficult to do if you plan for it in advance. I’ll show you how you can have $149,000 a year in distributions in retirement and only pay less than $8,140 a year in Federal income tax!

The key to limiting Federal income tax in retirement is to control your marginal tax bracket and take distributions from tax-free sources. If you do, you may be able to keep your taxable income below a key threshold of $94,050. For tax year 2024, for a couple filing Married Filing Jointly (MFJ) and their taxable income is below $94,050, their long-term capital gains and qualified dividend rate is 0%. That’s right! Z-e-r-o!

To achieve this in retirement, you have to plan for it in advance. That means in the accumulation phase before retirement, contributing towards ROTH retirement accounts and completing ROTH conversions in an efficient, strategic manner. Don’t get to retirement with most of your savings in pre-tax retirement accounts. If you do, the end result is having to pay taxes to distribute which will drive your taxable income even higher, especially once you reach the Required Minimum Distribution age.

If planned properly, in the distribution phase you will be able to distribute from ROTH sources, after-tax sources and pay 0% taxes on long-term capital gains and qualified dividends. To accomplish this, you need to create a financial plan and actively manage towards this goal. It is not likely to be achieved by happenstance. Obviously, everyone’s situation will differ with unique challenges, but each person can strive towards lower taxes in retirement with good planning. If this type of goal interests you, please reach out and let’s talk about it!

To discuss this or any other financial planning related topic please reach out to schedule an initial consultation at no cost at info@culbrethwm.com.

*This example is a thought exercise and not intended to be a precise calculation of tax owed.

Culbreth Wealth Management is a state registered investment advisor. Information and statements made here are not intended to create, and receipt does not constitute, a client relationship. There are risks inherent in investing, including the potential loss of principal.